A Typical Municipal Financing Problem

Table of Contents

- Structuring the $30M Tokenized Bond on Our RWA Rails

- Legal Architecture & SPV Framework

- Smart Contracts & Compliance

- Corporate Actions Automation

- Compliance by Design

- Institutional-Grade Security & Control

- Investor Distribution

- Local Residents

- Regional Banks, Family Offices & Institutions

- Secondary Market Liquidity via ATS Integration

- Transparent, Real-Time Disclosure

- Outcomes: How Tokenization Improved a Standard $30M Deal

- Measurable Financial Improvements

- Expanded Investor Base

- Liquidity Gains

- Operational Efficiency

- Trust & Transparency

- Summary

Structuring the $30M Tokenized Bond on Our RWA Rails

Legal Architecture & SPV Framework

Using our Issuer Portal + legal structuring module, the city established:

- A Special Purpose Vehicle (SPV) to hold the $30M debt obligation

- A digital representation of the bond through Tokenized Municipal Bonds (TMBs)

- An issuance structure aligned with Reg D 506(c) for accredited investors and state-level provisions for local residents

Traditional legal documents are mirrored 1:1 with smart-contract parameters in our Asset Digitization & Management Suite.

Bond Terms:

- Total issuance: $30,000,000

- Tenor: 15 years

- Coupon: 4.10% (tax-advantaged)

- Minimum unit size: $100 per token

- Settlement currency: Stablecoins (USDC), auto-converted from ACH/wire/card

This alignment let the city issue a legally compliant municipal bond in tokenized form, without changing the underlying rules - only the rails.

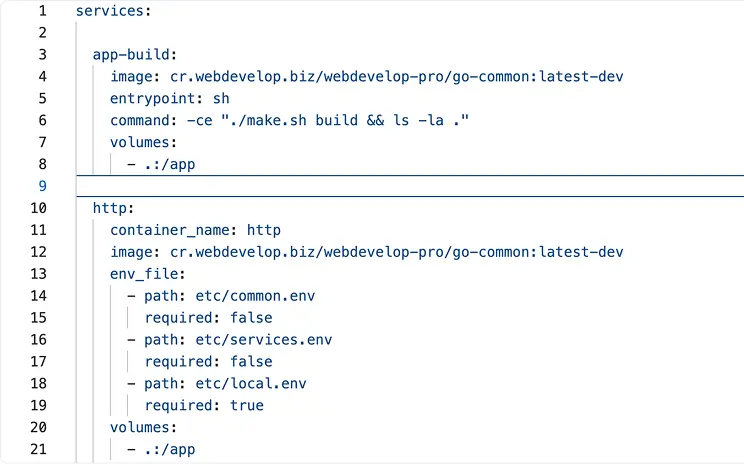

Smart Contracts & Compliance

Corporate Actions Automation

Our RWA smart-contract infrastructure automated:

- Interest (coupon) payments

- Redemptions and maturity events

- Capital account reconciliation

- On-chain audit logs tied to off-chain documentation

Compliance by Design

The token contract embedded rules for:

- KYC/AML

- Accreditation (Reg D 506(c))

- Geographic eligibility for local residents

- Transfer restrictions (hold periods, residency limits, AML events)

Transfers simply cannot execute unless conditions are met - moving compliance from back-office work to pre-trade enforcement.

Institutional-Grade Security & Control

- Fireblocks-powered institutional custody

- Multi-sig admin wallets

- Freeze/unfreeze powers for AML or regulatory events

- Fully audited smart contracts

This met the “possession or control” standard required for securities custody under U.S. frameworks.

Investor Distribution

Local Residents

Residents accessed the bond through the white-label Riverbend Invest app:

- KYC & residency verification in minutes

- Invest as little as $100

- View project milestones and live disclosures

- Receive stablecoin coupon payments automatically

This turned a $30M muni bond into a community-investable asset, not a financial instrument locked behind brokerage walls.

Regional Banks, Family Offices & Institutions

Institutions onboarded via:

- Fireblocks custody

- API-based portfolio integrations

- Automated reporting exports

- Support for Entities, Trusts, LLCs, and SDIRAs

This opened regional institutional demand that usually cannot efficiently access micro and mid-sized muni offerings due to operational friction.

Secondary Market Liquidity via ATS Integration

The $30M TMBs were listed on a partner Alternative Trading System (ATS) integrated with our rails:

- 24/7 trading

- Atomic settlement (TMB ↔ USDC)

- Orderbook restricted to KYC-approved wallets

- Full compliance enforcement at the token level

This produced the city’s first true secondary liquidity environment, something almost nonexistent for traditional muni issues of this size.

Transparent, Real-Time Disclosure

Through the issuer portal, the city published:

- Spend reports and invoices

- Project progress timelines

- Material events

- Quarterly financials

Each disclosure was hashed and timestamped on-chain for tamper-proof auditability.

Investors viewed a live “Where your dollars go” visualization through the mobile and web dashboards, dramatically improving municipal transparency.

Outcomes: How Tokenization Improved a Standard $30M Deal

Measurable Financial Improvements

- 30-40% lower issuance costs

- No traditional underwriter’s discount

- Reduced legal and administrative reconciliation costs

- Automated coupon payments and investor management

- Instantaneous on-chain settlement vs. slow legacy flows

Expanded Investor Base

- 1,200+ retail wallets with $100-$2,500 holdings

- Regional institutions taking larger tickets

- Local community participation increased political support

Liquidity Gains

- Secondary trades executed within 48 hours of issuance

- Small holders could liquidate partial stakes

- Institutions gained same-day adjustability

Operational Efficiency

- No manual cap-table updates

- Automated post-issuance lifecycle

- Instant reporting for auditors and regulators

Trust & Transparency

- Immutable reporting

- On-chain auditability

- Real-time project milestone tracking

We issued a standard municipal bond - but on next-generation infrastructure. We reduced our costs, broadened access, improved transparency, and created optionality we never had before.

- Riverbend’s mayor

Summary

- Tokenization isn’t “crypto”; it’s upgrading public finance plumbing

- The technology works within existing legal frameworks

- Our rails turn a traditional municipal bond into a modern, programmable financial instrument

- We unlock efficiency for issuers and access for investors