Regulatory Compliance Engine

The definitive infrastructure that unifies licensing, investor verification, and on-chain compliance for digital assets.

The Barriers Regulatory Compliance Engine Breaks

The Four Pillars of Regulatory Infrastructure

Full-Stack Licensing

Access a complete, integrated licensing solution.

Automated Onboarding

Verify investor identity, status, and limits.

On-Chain Compliance

Deploy tokens with built-in, "smart" rules.

Legal & Custody Automation

Streamline SPV creation and asset custody.

Full-Stack Licensing Framework

Access the required regulatory licenses in one unified stack.- Integrated solution for Broker-Dealer, Funding Portal, and Transfer Agent registrations.

- A built-in, licensed Alternative Trading System (ATS) for compliant secondary liquidity.

- Automate state-level "Blue Sky" compliance and jurisdictional rule checks.

Remove the multi-million dollar barrier to entry and operate with an end-to-end licensing solution.Automated Investor Onboarding

A reusable, compliant identity layer for your investors.- Instant KYC/AML verification compliant with the Bank Secrecy Act.

- Automated accreditation verification for Reg D (Rule 506c) investors.

- Auto-calculate and enforce investment limits for Reg CF & Reg A offerings.

- Run automated "Bad Actor" screening for all issuers and related parties.

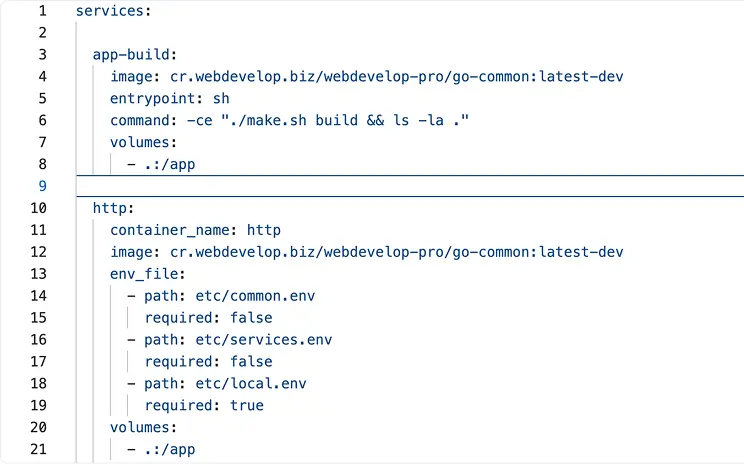

Create a "compliance wallet" for your investors-verify them once to instantly unlock all future offerings."Smart Security" On-Chain Compliance

Issue tokens with programmable, on-chain compliance rules.- Deploy permissioned tokens with built-in transfer restrictions and lock-up enforcement.

- Manage the "on-chain vs. off-chain" record, with the Transfer Agent as the legal source of truth.

- Automate SEC filings (Form C, Form D) and Offering Circular/ PPM management.

- Ensure all dividend/interest distributions are compliant with the token's rules.

Solve the "permissioned" token problem. Compliance is enforced by the code, not by a manual post-trade process.Legal Structuring & Custody Engine

Automate the legal "wrappers" and custody for your assets.- Legal-tech engine to automatically connect blockchain assets with SPVs or LLCs.

- Integrate with qualified custodians to safeguard underlying real-world assets.

- Ensure 1:1 asset-to-token backing and verifiable legal title control.

Reduce your legal setup time from months to days and provide verifiable, regulator-ready proof of backing.