Investment Engine

The complete, full-stack infrastructure to power compliant, transparent, and modern capital formation.

The Barriers Digital Investment Engine Breaks

The Six Steps of Digital Capital Formation

STEP 1

Onboarding

STEP 2

Compliance

STEP 3

Funding

STEP 4

Management

STEP 5

Distributions

STEP 6

Liquidity

Unified Onboarding & Verification

A frictionless, compliant onboarding experience for your investors.- Integrates with Alloy, Plaid, and other top tier providers for instant KYC/AML.

- Automated digital accredited investor verification for Reg D investors.

- Auto-calculates accreditation limits for Reg CF compliance.

Foster investor conversions. Transform onboarding from a bottleneck to an automated flow.Automated Compliance & Signing Layer

Digitize the entire filing and document lifecycle.- Auto-generated templates for SEC filings (Form C / Form D).

- Smart document builder for subscription agreements and investor certificates.

- Immutable audit logs and reporting for every action.

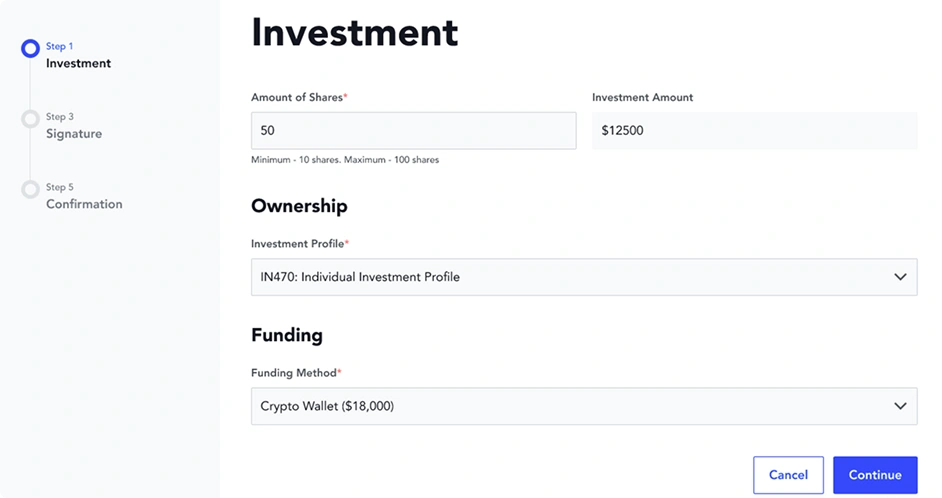

Launch compliant offerings with zero friction and dramatically reduce regulatory risk.Integrated Payments & Smart Escrow

All payment rails, one seamless and reconciled flow.- Connects card, ACH, wire, and crypto rails in a single checkout.

- Funds automatically route to regulated escrow accounts.

- Real-time tracking and automated refunds if targets aren't met.

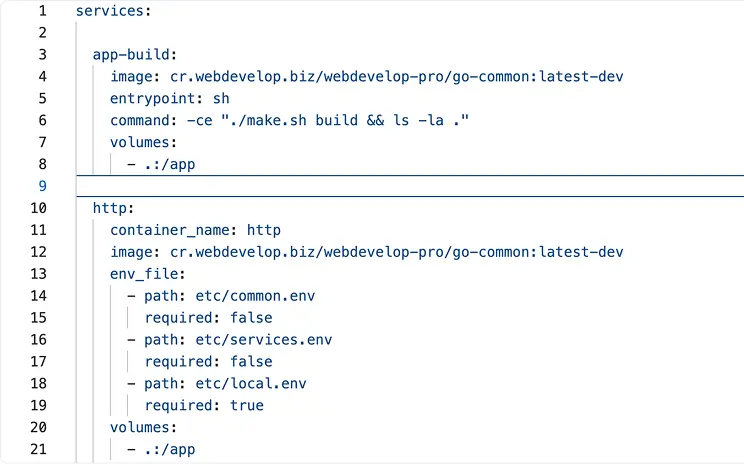

Eliminate manual reconciliation. API-level tracking for a fully auditable fund flow.Post-Investment Management Suite

Give investors real-time visibility into their holdings.- Dynamic cap tables synced with smart contracts or transfer agents.

- Secure, white-label valut for communications, reports, and K-1s.

- Role-based dashboards for issuers, admins, and investors.

Build investor confidence and dramatically reduce support tickets with a professional, transparent portal.Automated Distribution Engine

The modern back office for investor payouts.- Automated dividend and distribution engine.

- Supports both on-chain and off-chain (ACH/wire) payouts.

- Full reconciliation and reporting for issuers and investors.

Eliminate spreadsheet-based payout management and deliver timely, accurate returns.Tokenization & Liquidity Readiness

A future-proof platform ready for digital liquidity.- Tokenization module turns your compliant securities into digital assets.

- Smart contracts represent investor ownership and sync with off-chain compliance data.

- Ready for integration with registered ATSs (tZERO, InvestX Markets).

Offer investors a clear path to future liquidity and position your platform for the future of finance.